What You Should Know About The Housing Market Today

April Market Update: National Slowdown Meets NJ Inventory Rebound

Note: The statistics below reflect national housing trends unless otherwise stated. The northeast, including NJ, continues to inch upwards in median price.

As we wrapped up April 2025, the national housing market sent a clear message: momentum is slowing. Weekly pending home sales—homes that went under contract—fell 10% compared to the same week in 2024. Single-family homes were down 8.6%, and condo sales dropped a striking 19%. This soft rebound, coming after the Easter holiday lull, signals that buyers are still holding back.

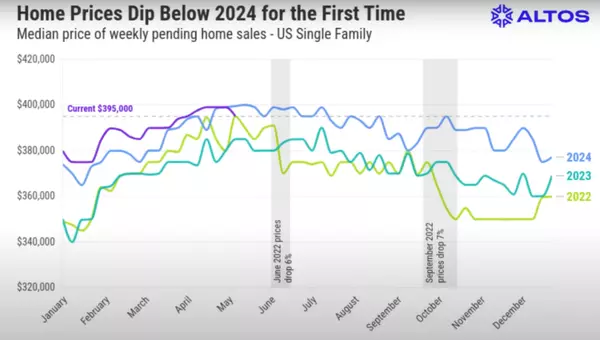

But what’s more striking? For the first time in nearly two years, the median price of homes under contract actually declined year over year. Last year, the national median for weekly pending sales was $399,000. This April, it dipped to $395,000. One week doesn't make a trend, but it marks a potential shift in pricing momentum.

What’s Driving the National Changes?

-

Rates: While mortgage rates inched down slightly, the 30-year fixed is still hovering around 6.8%.

-

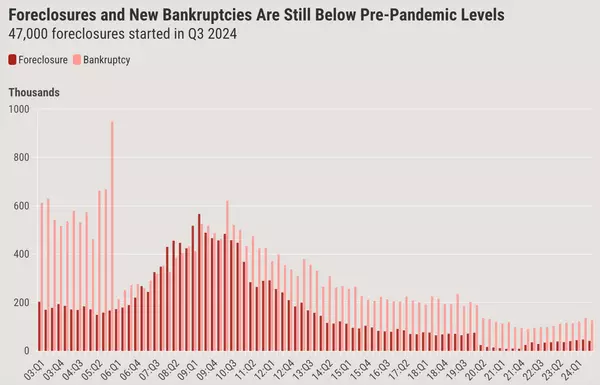

Inventory is growing: Nationally, there are now 744,000 single-family homes on the market, 33% more than this time last year and the highest level since before the pandemic.

-

Price cuts are increasing: The share of homes with price reductions jumped to 36.5% Usually this number is around 33%.

-

40% of homeowners have no mortgage: This has a major impact on how sellers behave. Without a mortgage, many homeowners don’t feel pressured to sell, even in a slower market. Many homeowners choose to simply take their home off the market and stay put if they aren't able to get the price they want.

What’s Happening in New Jersey?

Here in New Jersey, we’re seeing a welcome but modest rise in inventory. According to the New Jersey REALTORS® April update, active listings across the state were still down about 60% from 2019, but have begun to climb in recent weeks. New listings rebounded strongly after Easter, especially in North and Central Jersey—two regions where inventory has remained severely restricted since the pandemic.

-

As of April 2025, NJ had roughly 13,300 active listings, compared to over 44,000 in April 2019.

-

Median sale prices remain firm in most NJ counties, especially in areas with good schools and strong commuter access.

-

Many NJ homeowners also own their homes outright, which reinforces the trend of low-forced listings. These sellers can wait out the market.

- With the average rent for a two bedroom home in NJ hovering around $2,700 a month, many sellers would pay more for monthly housing if they sold their home.

What Buyers Should Know

This could be your moment to act. While prices in New Jersey haven’t dipped like the national average, the increase in inventory could offer more options and slightly less competition. And if rates soften later this year, that window may tighten again. Just keep in mind: most sellers don’t “need” to sell, so negotiation strategy matters.

What Sellers Should Consider

Buyers are cautious and watching prices closely. With national sentiment shifting, pricing your home correctly from day one is critical. Listings that linger are more likely to face price cuts. That said, many New Jersey towns are still seeing very strong demand. Homes priced strategically are still accepting offers on average in just a few days, and well over list price.

Bottom Line:

Whether you're buying or selling, the most important aspect is having a great strategy. Market knowledge is an important piece, but how you apply tactics to get the best outcome is what makes or breaks your real estate experience. Wondering what strategies I'm using right now with my top clients to win in this market?

Email me at nina@ninasellsnj.com or text me at (908) 510-9094 to get started.

Recent Posts