Should You Buy Now or Wait? (National Data)

Is Now a Good Time to Buy a Home? Insights for NJ Buyers

In today’s housing market, many prospective buyers are asking tough questions: Will home prices rise or fall? Are mortgage rates going to improve? While there’s no “perfect” time to buy, understanding market trends can help you make a confident decision.

Market Snapshot

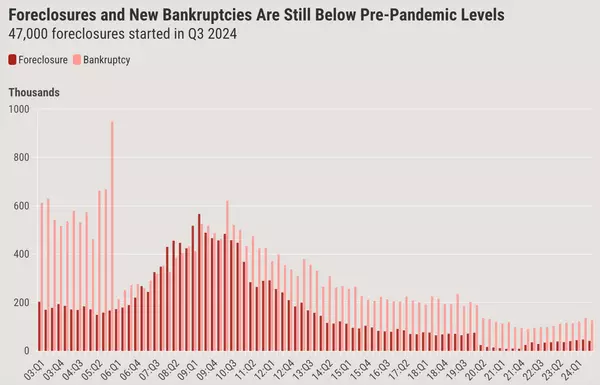

Rapid changes in mortgage rates have created uncertainty, but they’ve also opened up opportunities. Home prices are expected to finish 2024 up 5% nationally compared to last year. Meanwhile, the number of unsold homes has grown by 27%, offering buyers more options.

Mortgage rates, while stabilizing, remain higher than their pandemic lows. Experts, including HousingWire analysts, predict rates will stay between 5.75% and 7.25% in 2025. Redfin projects a similar stabilization around 7%. Though rates are far from the 3% lows of 2020-2021, they’re also not expected to spike dramatically.

Zillow economist Orphe Divounguy suggests that affordability will remain a challenge, but there are positive signs. "More homes for sale, stable rent growth, higher real incomes, and mortgage rates more likely to ease than rise bode well for first-time buyers," he says.

Why Buying Now Could Make Sense

Even in today’s market, buying a home could be a smart move for financially prepared buyers. Consider these factors:

- Increased Inventory: With more unsold homes on the market, buyers have a wider selection and potentially less competition.

- Stabilizing Rates: Mortgage rates are expected to remain steady or ease slightly in the coming year.

- Strong Economy: According to Chase Home Lending's Patricia Maguire-Feltch, the improving economic landscape supports housing stability and recovery.

For renters, slowing rent growth might make it easier to save for a down payment. CoreLogic reports that single-family rental prices grew by just 2% year-over-year as of September 2024, the lowest growth rate in over four years.

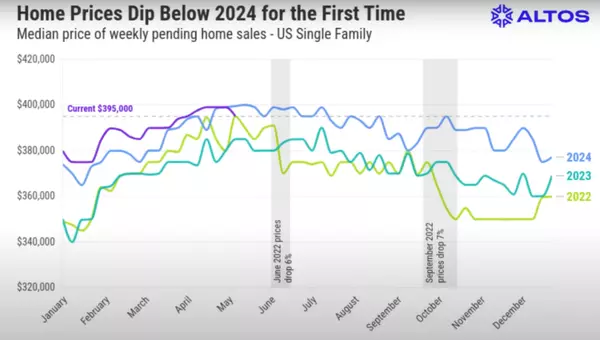

Home Prices: What to Expect

Despite some easing, home prices aren’t likely to drop significantly. In October 2024, the median U.S. home price was $420,400, slightly lower than the highs of 2022 ($442,600) and 2023 ($423,200). This data suggests that waiting for a major price decline may not be realistic.

The Lock-In Effect

Another dynamic impacting the market is the "lock-in effect." Approximately 70% of homeowners with existing mortgages are locked into rates below 5%, making them less likely to sell or move. If rates decline further, this could soften the lock-in effect and increase market activity, creating more opportunities for buyers.

Renting vs. Buying

For renters, record-high numbers (45.6 million in 2024) underscore the appeal of homeownership as a way to build equity and stability. Stabilizing rents and slowing rental price growth give renters a chance to save for their future homes.

Final Thoughts

Is now the right time for you to buy? That depends on your financial readiness, goals, and priorities. While the market may seem daunting, opportunities exist for those prepared to act.

If you’re considering buying in New Jersey, I can help you navigate the market. With expertise in Middlesex, Mercer, Monmouth, and Union Counties, I’ll provide the local insights you need to make informed decisions. Let’s discuss your goals and create a plan tailored just for you!

Recent Posts