Breaking Statistics: Key Market Trends To Know for 2025

The U.S. Housing Market: Key Trends Heading Into 2025

The U.S. housing market continues to evolve as we approach 2025, shaped by several dynamic trends. Despite high mortgage rates, persistent low inventory, and shifts in buyer behavior, the market remains resilient due to strong household equity, rising home values, and steady demand. Here’s an overview of the key factors influencing the market, based on the latest insights.

1. Home Sizes Are Shrinking

Since 2016, the average size of newly constructed single-family homes has declined by 12%. This trend reflects changes in consumer preferences, with many buyers prioritizing affordability over extra square footage. Builders are responding by designing more efficient spaces that cater to budget-conscious buyers.

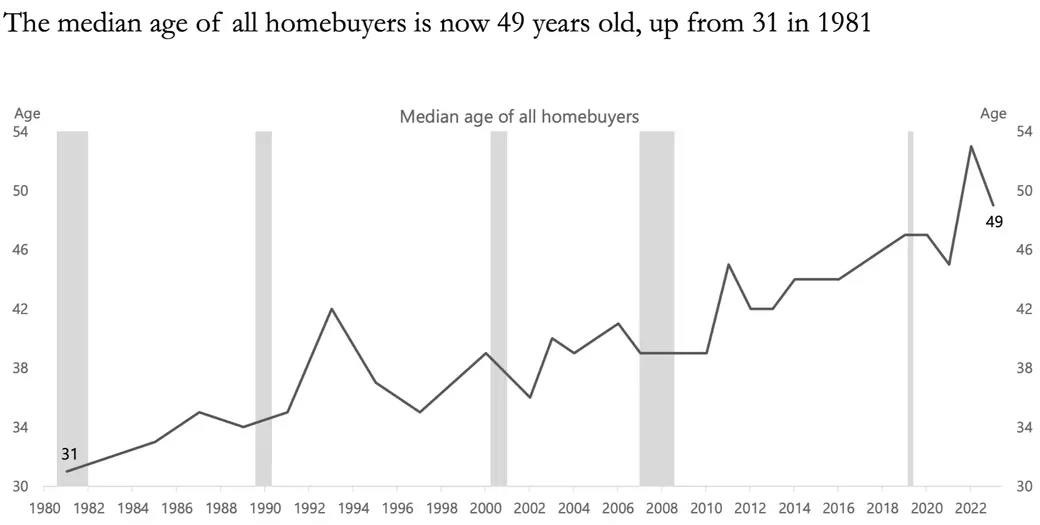

2. Aging Homebuyer Demographics

The median age of U.S. homebuyers has risen significantly, reaching 49 years in 2024 compared to 31 years in 1981. This shift can be attributed to economic factors delaying homeownership for younger generations and the growing influence of older, financially established buyers in the market.

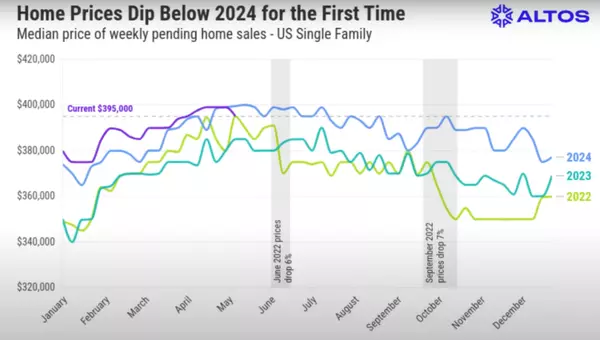

3. Rising Home Prices and Equity

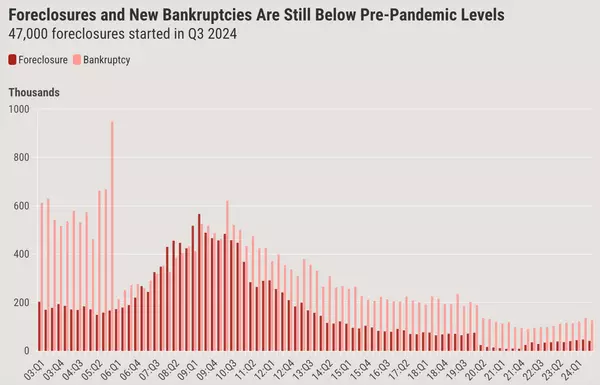

The U.S. housing market is forecasted to see a 10.8% increase in home prices over the next year. Coupled with record-high household equity levels—averaging 73% of home values—this trend highlights the market’s strength. Homeowners are in a favorable position to leverage their equity for investments or upgrades.

4. Mortgage Rates and Housing Affordability

While over 50% of current mortgages have an interest rate below 4%, today’s buyers face affordability challenges with average monthly payments nearing $2,900 for a new mortgage. However, 95% of outstanding mortgages are fixed-rate, providing financial stability to many homeowners.

5. Limited Inventory Supports Seller Advantage

The housing market’s inventory remains critically low. With fewer homes available, competition among buyers continues to drive up prices. This environment creates opportunities for sellers to maximize profits while buyers must act decisively when properties become available.

6. Increasing Rental Market Preference

A record-high 36% of Americans say they would rent if they moved today. This preference for renting, driven by affordability concerns and tight credit conditions, is reshaping housing demand.

What These Trends Mean for Buyers and Sellers in New Jersey

As a New Jersey realtor, these national trends align with the state’s local market dynamics. Limited inventory and high demand, particularly in desirable areas like Middlesex, Monmouth, and Mercer Counties, mirror the national housing climate. For buyers, understanding these challenges is crucial to navigating the market, while sellers have unique opportunities to capitalize on rising equity and buyer demand.

Looking Ahead

The 2025 housing market will continue to be shaped by these trends, along with advances in technology and changing consumer preferences. Whether you’re looking to buy or sell, partnering with an experienced real estate professional is key to making informed decisions in this dynamic environment.

Are you ready to make your next move in the New Jersey real estate market? Contact me today to get started!

Recent Posts