Oct 1st, 2025 - National and State Market Trends

October 2025 Real Estate Market Update: National Trends and New Jersey Insights

As we move through October 2025, the U.S. housing market continues to balance between strong buyer demand and higher borrowing costs. In New Jersey, the market is showing resilience, with rising prices and expanding inventory that’s creating opportunities for both buyers and sellers.

National Housing Market Highlights

-

Inventory: U.S. housing inventory dipped slightly last week, from 862,833 to 862,575 homes. While unusual for late September, this mirrors pre-2020 seasonal patterns.

-

Pending Sales: Weekly pending home sales reached 65,152, the highest since the 2022 downturn, up from 62,576 this time last year.

-

Mortgage Applications: Purchase applications are up 0.3% week-over-week and 18% year-over-year, marking 34 consecutive weeks of annual growth.

-

Mortgage Rates & Spreads: Mortgage rates averaged 6.33%–6.38% last week, with spreads improving to their best levels of the year. If spreads normalized, rates could be closer to 6.0%.

-

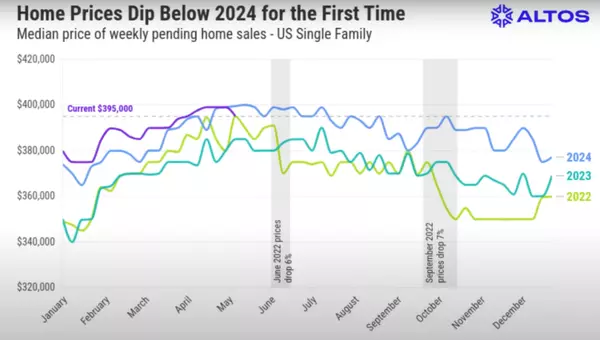

Price Cuts: 41.6% of listings nationally have taken a price reduction, up from 39% last year.

Home Sales Snapshot

-

New Homes: Sales surged 20.5% month-over-month in August 2025, reaching an annualized pace of 800,000 units. Median sales price: $413,500.

-

Existing Homes: Sales came in at 4.0 million SAAR, down slightly from July but 1.8% higher year-over-year. Median price: $422,600, the 26th straight YoY increase.

New Jersey Housing Market

The Garden State continues to follow national trends while showing its own unique dynamics:

-

Prices: Home prices in New Jersey rose 5.8% year-over-year in August 2025, with a median sale price of $584,700.

-

Sales Volume: The number of homes sold was down about 5.2% YoY, reflecting buyer hesitation due to higher borrowing costs.

-

Inventory: Listings are up 10.6% YoY, giving buyers more choice compared to the tight markets of 2022–2023.

-

Days on Market: Homes are taking about 40 days to sell on average, up slightly but still competitive.

-

Long-Term Value: NJ’s house price index hit 921.48 in Q2 2025, confirming steady growth.

-

Regional Strength: In April 2025, single-family closed sales rose 11.4% statewide, with median prices climbing nearly 9% to around $560,000.

What This Means for Buyers and Sellers

-

Buyers: With inventory rising and price cuts becoming more common, you have more leverage than in recent years. However, affordability remains tight in high-priced areas like Monmouth and Bergen Counties.

-

Sellers: Pricing right matters more than ever. Over 40% of listings nationally have reduced prices, and NJ sellers are facing the same reality. Well-priced, move-in ready homes are still moving quickly.

-

Investors: Rising rents and limited affordable inventory continue to make multifamily and rental investments attractive in markets like Middlesex and Union Counties.

Final Takeaway

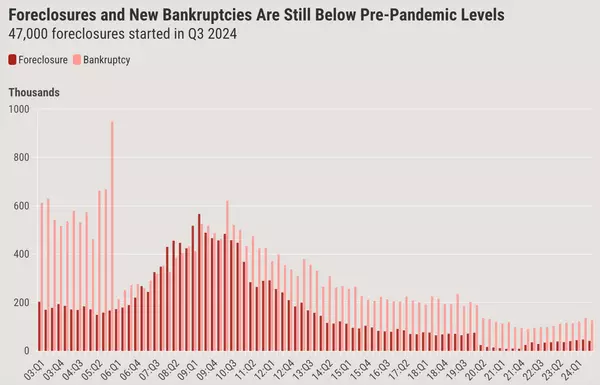

The October 2025 housing market is one of adjustment, not decline. Nationally, demand is holding strong with lower mortgage rates on the horizon, while in New Jersey, rising prices and growing inventory signal a healthier balance.

If you’re planning to buy or sell in Middlesex, Mercer, Monmouth, Somerset or Union County, staying informed and working with a knowledgeable local expert is key.

📩 Contact me at nina@ninasellsnj.com for a personalized strategy based on both national and New Jersey market trends.

Recent Posts