Why there's no housing crash coming: The truth is in the data

Why a Housing Crash Isn’t on the HorizonHomeowners are financially secure, and the data shows little cause for concern.

As 2024 draws to a close, the long-standing predictions of a housing market crash continue to miss the mark. Updated credit data from the New York Federal Reserve provides solid evidence that today’s homeowners are in a significantly stronger position compared to the pre-2008 era. Let’s explore why the current market is fundamentally different.

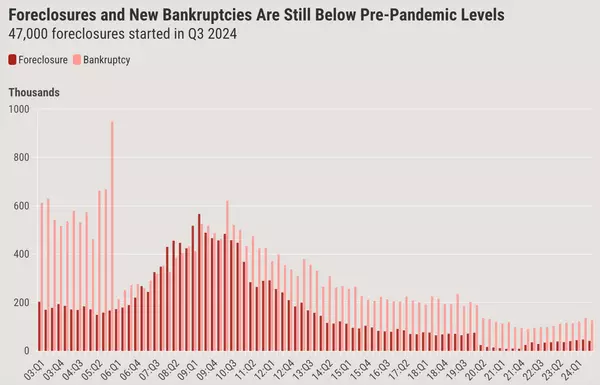

Foreclosure Data: A New Reality

The 2008 housing crisis didn’t happen overnight; it was years in the making. Toxic credit practices from 2005 to 2008, such as adjustable-rate loans with ballooning payments, created widespread financial instability. This led to a surge in foreclosures, exacerbated by the job losses of the Great Recession.

Today, however, the landscape is entirely different. Following the introduction of the Qualified Mortgage (QM) rule in 2010, most loans are now stable 30-year fixed-rate mortgages. Refinancing waves in recent years have also helped homeowners lock in low interest rates, improving their financial standing. As a result, foreclosure rates have been consistently low. Simply put, the conditions for a 2008-style housing crash no longer exist.

FICO Scores Show Financial Strength

The creditworthiness of today’s homeowners is a key factor in the market's stability. Homebuyers now typically have high FICO scores, which reflect improved underwriting standards and healthier financial habits. Additionally, rising wages and better cash flow have bolstered the financial health of homeowners, ensuring they can manage their mortgage obligations with less stress.

Credit Stress Remains Low

While every economic cycle brings challenges, the severe credit stress experienced during the 2008 crisis is unlikely to be repeated. Thanks to stricter lending standards and the prevalence of 30-year fixed mortgages, homeowners are better equipped to weather economic downturns. Even during periods of economic strain, such as the early days of COVID-19 and the inflationary pressures of the past few years, homeowners have remained resilient.

Interestingly, credit stress levels have yet to return to pre-pandemic norms, despite expectations. This is another sign that the market is far from the distressed conditions of the 2008 era.

New Listings Highlight Market Stability

One telling sign of market health is the level of new home listings. Data from Altos Research shows that new listings in 2024 are at their lowest levels in years—just 48,863 for a recent week in November. For context, during the same period in 2009, there were 274,614 new listings, with similarly high numbers in 2010 and 2011. Back then, many of these listings came from financially stressed sellers, which flooded the market and drove prices down. Today, such distressed selling is virtually nonexistent.

Strong Equity and Low Debt Levels

Another factor insulating the housing market from a crash is homeowners’ equity. Over 40% of homes are owned outright, with no mortgage. Among those with loans, the average loan-to-value (LTV) ratio is under 50%. Compare that to 2008, when the average LTV was nearly 85%, and you see a stark difference in financial security. Additionally, the median down payment for 2024 stands at 15%, giving homeowners a solid stake in their properties.

A Reassuring Conclusion

For anyone predicting a repeat of the 2008 housing crash, the data tells a different story. Homeowners are in a strong financial position, supported by sound lending practices, low foreclosure rates, and significant equity.

This Thanksgiving, if someone at the dinner table insists that a housing crash is imminent, share these insights. The numbers paint a clear picture: today’s housing market is built on a foundation of financial stability, not the shaky practices of the past.